Commodity Polymers Markets

HMX is the execution platform of choice for commodity plastics. Whether a participant needs to buy or sell physical resin in railcar quantities or has a desire to manage the risk of volatile pricing through the use of financial transactions, HMX is the marketplace for price discovery, transparency and execution in an equal access market.

Transaction Types

Transactions can be executed on HMX in two ways:

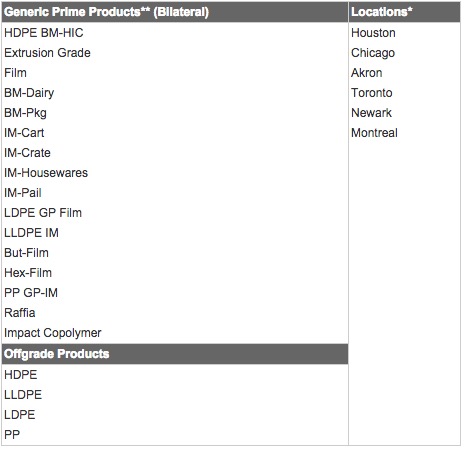

- BILATERAL -- Through a built in credit management matrix individually and securely managed by each participant company. Bilateral transactions settle through physical delivery at the appropriate agreed delivery location. The contracts between counterparties to bilateral transactions are typically those contract arrangements already existing between such counterparties.

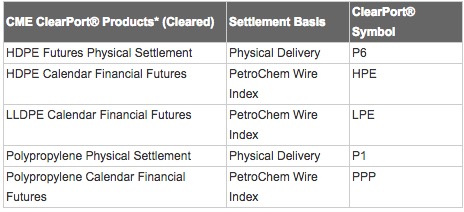

**While HMX can add additional products/locations upon request, the plastics products available for physical transactions are assumed to be generic prime resin (without guarantee of a specific certification) of the more widely used large volume commodity grades produced by a variety of producers. HMX has published generic specifications for a broad range of grades that are available for trade on HMX. However, these specifications are intended to be used as a guide only and not a guarantee. HMX does not manufacture, buy, sell, distribute, transport, store or otherwise take title to any physical resin, nor do we represent or guarantee the quality, specifications or delivery of any product a participant buys or sells with a counterparty they have transacted with through HMX. For purposes of establishing the price basis, postings assume delivery is fob the stated location via railcar with actual delivery location - if different from the traded location or trading hub - to be negotiated post transaction execution or agreed to during and while using the negotiation function on the HMX platform. Actual physical delivery time is assumed to be based on industry standard terms for railcar delivery, EX: Purchase and sale of a September railcar assumes the railcar will ship in September and actual delivery time will occur when rail logistics permit and as arranged and agreed between the counterparties. - Cleared -- Through CME ClearPort®. Cleared transactions are available to participants who are registered for CME ClearPort® and have an account with a registered clearing firm (FCM).

*CME ClearPort® contract specifications can be found at the CME ClearPort Product Slate

**HMX can add additional products/locations upon request. HMX does not manufacture, buy, sell, distribute, transport, store or otherwise take title to any physical product, nor do we represent or guarantee the quality, specifications or delivery of any product a participant buys or sells with a counterparty they have transacted with through HMX.

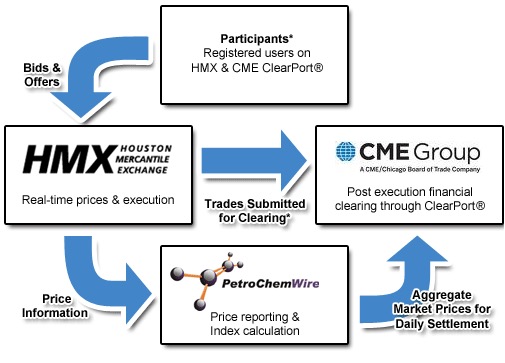

HMX Commodity Plastics transactions are part of the settlement index process

*Participants must have a relationship with a futures clearing firm (Futures Commission Merchant or FCM) prior to executing cleared trades.

All transactions executed on the HMX Platform that are intended for clearing are submitted to either of the above clearinghouse through the HMX system on behalf of clearing participants by HMX Futures LLC. HMX Futures LLC is an approved Introducing Broker registered with the National Futures Association.